Your current location is:Fxscam News > Platform Inquiries

Binance exits Russian market, stops Ruble transactions from Nov 15, 2023

Fxscam News2025-07-23 06:08:26【Platform Inquiries】0People have watched

IntroductionYixin trading platform,China's regular foreign exchange trading platform rankings,1. Binance Prepares to Completely Exit the Russian Market, Will Stop Accepting Ruble Deposits and Wi

1. Binance Prepares to Completely Exit the Russian Market,Yixin trading platform Will Stop Accepting Ruble Deposits and Withdrawals Starting November 15, 2023

Cryptocurrency exchange titan Binance officially announced on November 10 that it will stop accepting deposits and withdrawals in Russian rubles starting November 15, 2023, and expects to terminate ruble withdrawals by January 31, 2024. Binance advises users to withdraw their ruble deposits as soon as possible, while customers can transfer funds to CommEX. This exchange has acquired all of Binance's operations in Russia.

2. ASIC: Retail Over-The-Counter Derivatives Investors Receive Over 17.4 Million Australian Dollars in Compensation

According to the Australian Securities and Investments Commission (ASIC), since March 2021, eight issuers of over-the-counter derivatives who violated financial services laws have compensated or promised to compensate over 2,000 retail customers more than 17.4 million Australian dollars.

3. dxFeed Appoints Bruce Traan as Global Head of Indices

Capital market data service provider dxFeed announces the appointment of Bruce Traan as the new Global Head of Indices. With over twenty years of experience in the financial sector and outstanding performance in index management, his joining is set to help dxFeed fulfill its commitment to provide innovative and comprehensive index solutions to the global financial markets.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(92)

Related articles

- Y&C Financial Investment is a Scam: Stay Cautious

- The Chinese yuan remains stable with a slight appreciation, but tariff uncertainties persist.

- US dollar's trend: Trump's policies, oil prices, and geopolitics shape the future.

- The dollar hit a seven

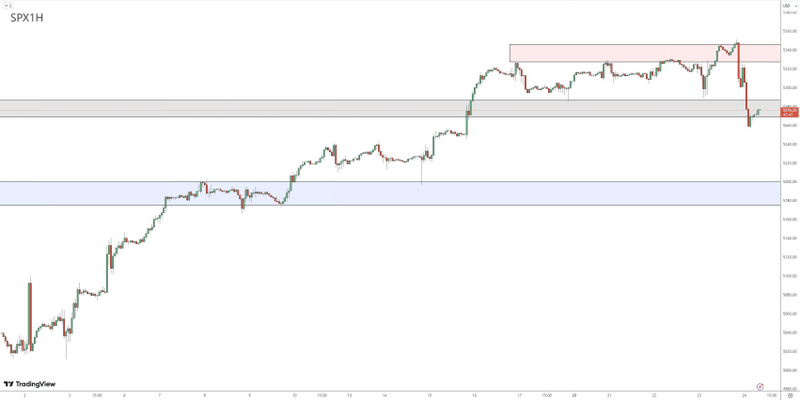

- Market Insights: Mar 21, 2024

- The Bank of Canada cut rates by 50 basis points to address Trump’s tariff risk.

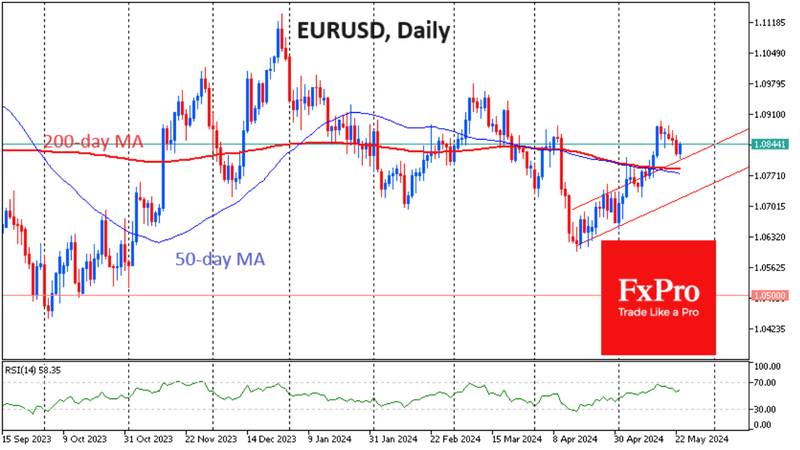

- The euro risks parity with the dollar; CPI and ECB decision are key.

- Gold prices rise slightly, fueled by U.S. CPI and rate cut expectations, amid geopolitical tensions.

- The UK FCA blacklist has been updated with 18 new entries, including 3 clone firms.

- Dollar pares losses as Trump delays new tariffs, leaving future policy unclear.

Popular Articles

- Is Opixtech a legitimate forex company? Are the high returns of Opix Algo real?

- Yen falls, dollar under pressure, market eyes central banks and Ukraine talks.

- The US dollar peaks as yuan falls below 7.35, spotlighting central bank efforts.

- The US dollar peaks as yuan falls below 7.35, spotlighting central bank efforts.

Webmaster recommended

Market Insights: March 5th, 2024

Gold prices hit a record high, potentially reaching $3,000 next year.

U.S. dollar strengthens, Euro drops 1% on Trump’s tariff threats and strong U.S. data.

Former BOJ Official: Trump Policies Add Uncertainty, Rate Hike May Be Delayed to March

Hong Kong SFC Warns: "Yieldnodes.com masternode pool"

The U.S. dollar fell slightly Thursday as Trump urged rate cuts but gave no clarity on tariffs.

Trump to announce new tariffs in April on automobiles, semiconductors, and pharmaceuticals.

Trump's tariff statement strengthens the dollar, but economists warn of potential backfire.